Bank of Canada rate hike

As of 1 October 2015 Overnight Repos and Overnight Reverse Repos formerly called Special Purchase and Resale Agreements and Sale and Repurchase Agreements are transacted on a. In a press release the central bank said The effects of COVID-19 outbreaks ongoing supply disruptions and the war in Ukraine continue to dampen growth and boost prices.

Central Bank Watch Boc Rba Rbnz Interest Rate Expectations Update

Typically the Bank of Canada rate changes 025 as needed with 05 changes not being uncommon especially during periods of economic instability.

. Economists tracked by Bloomberg were expecting a 67 per cent increase. The Bank of Canada today increased its target for the overnight rate to 1 with the Bank Rate at 1¼ and the deposit rate at 1. The numbers pave the way for another outsized Bank of Canada rate hike next week perhaps taking the policy rate to 4 per cent the highest since 2008 as more economists are now predicting.

The Bank has repeatedly stated its commitment to raise rates in 2022. All eyes will be on the Bank of Canadas interest rate decision this week which some say could be its last increase of the year and perhaps of this rate cycle. The Bank of Canada hiked its benchmark overnight rate by 75 basis points to 325 per cent on Wednesday.

26 which would bring the Banks policy rate to 375 per cent. Central banks resolve not to let up in. Growth is expected to slow to about 2 in the third quarter as consumption growth moderates and housing market activity pulls back following unsustainable strength during the pandemic.

For every 50 basis-point hike a homeowner with a variable rate mortgage can expect to pay about 28 more a month for every 100000 of mortgage said Victor Tran a mortgage and real estate expect for Ratesdotca. The Bank is also ending reinvestment and will begin quantitative tightening QT effective April 25. The Bank of Canada announced Wednesday that it will increase its benchmark interest rate by a full percentage point taking a larger than expected hike to tame decades-high levels of inflation.

Another interest rate hike from the Bank of Canada means some Canadians could be spending a lot more on their monthly mortgage bills. Markets are pricing in a 75-bps hike which would bring the Bank of Canadas overnight rate to 325 just above its 2-3 neutral range and into restrictive territory. When the rate went up by one full point on July 13 of 2022 it was one of the biggest jumps ever made.

The Bank of Canada today increased its target for the overnight rate to 3¼ with the Bank Rate at 3½ and the deposit rate at 3¼. Central bank will stay aggressive on interest rates had some observers speculating that the Bank of Canada hike on Sept. Interest rate announcement and Monetary Policy Report.

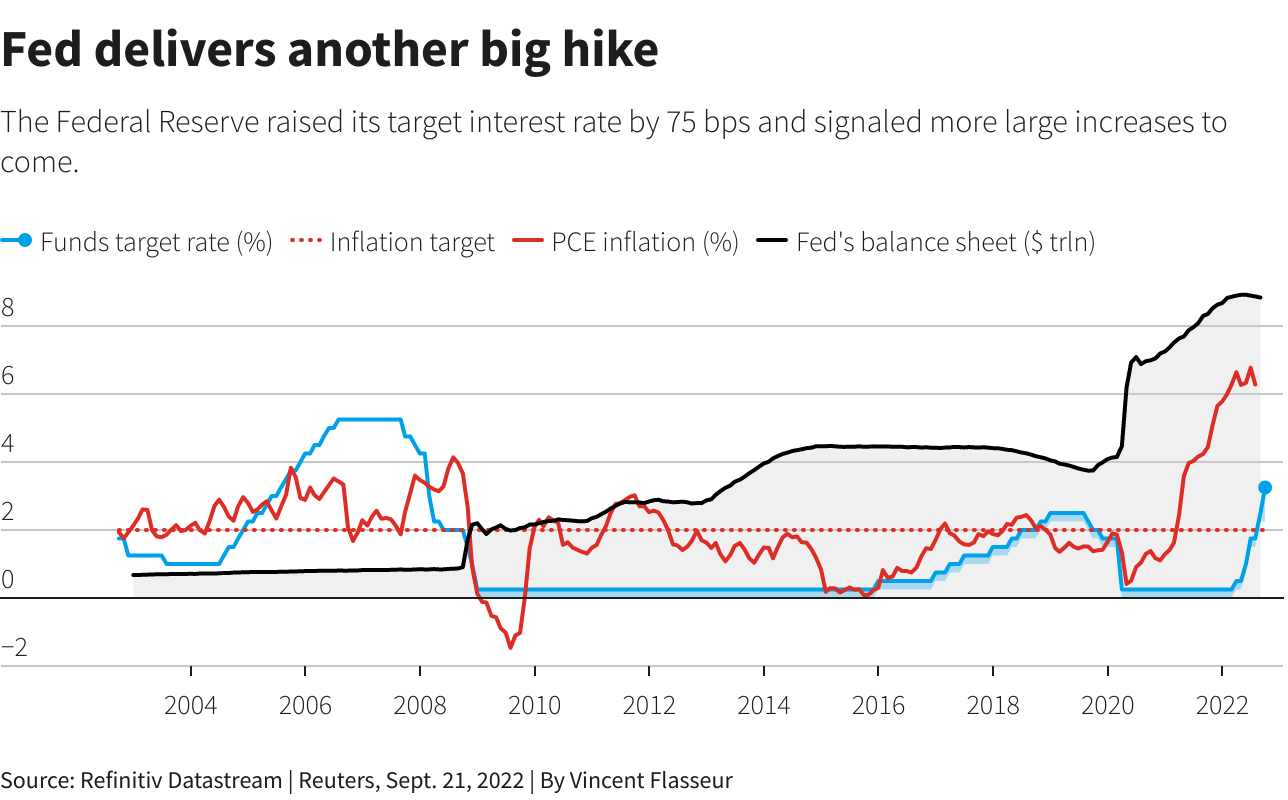

The question now on Canadians minds is when will the cycle of rate hikes come to an end. The Bank is also continuing its policy of quantitative tightening. The Fed delivered its third straight rate increase of 75 basis points on Wednesday and signaled borrowing costs would keep rising underscoring the US.

The central bank in a regular rate decision hiked its policy rate to 325 from 250 matching analyst forecasts and hitting a level not seen since April 2008. The Bank of Canadas aggressive language along with its 75-basis-point boost in the bank rate sends the message that further interest rate hikes are ahead to bring down inflation says Douglas. The latest data released by Statistics Canada on Wednesday shows the consumer price index CPI up 69 per cent year-over-year in September.

See what it isand what it means for you. If CIBC economists are correct the Bank of Canadas expected rate hike next week will be its last of this rate-hike cycle. His message that the US.

The most immediate impact will be for variable rate mortgage. Economists are expecting the Bank of Canada to continue its aggressive rate hike campaign after inflation data came in higher than expected. There continues to be a consensus that the Bank of Canada will continue hiking rates into October 79 and many think at the December 37 meeting.

7 could even be a full percentage point. Some of Canadas major banks are forecasting the central bank will the key interest rate by three-quarters of a percentage point bringing it to 325 per cent. Maturing Government of Canada bonds on the Banks balance sheet will no longer be replaced and as a result.

TD and RBC economists expect a 50 basis-point hike on Oct. The Bank of Canada raised its overnight interest rate by 75 basis points to 325 per cent on Wednesday its fifth consecutive hike in its. The Bank expects Canadas economy to grow by 3½ in 2022 1¾ in 2023 and 2½ in 2024.

The OMMFR is an estimate of the collateralized overnight rate compiled at the end of the day by the Bank of Canada through a survey of major participants in the overnight market. The Bank of Canada is expected to deliver another interest rate increase next Wednesday with forecasters split between a half and three-quarters of a percentage point hike. When will the rate-hike cycle end.

There is generally a consensus amongst economists that more hikes will follow before the end of 2022 but a new report by the Organisation for Economic Co-operation and Development OECD. In a report published last week economists Benjamin Tal and Karyne Charbonneau say they expect the Bank of Canada to hike another 75 bps next week and will then call it a day leaving the overnight target rate at 325 for the duration of 2023. Bank of Canada delivers 075 percentage point rate hike.

At the heart of the Bank of Canadas monetary policy is the target for the overnight rate. The global and Canadian economies are evolving broadly in line with the Banks July projection. The Bank estimates that GDP grew by about 4 in the second quarter.

A history of the key interest rate. The last time the Bank of Canada rate was raised. Bank of Canada rate hike September 7 2022.

Some of Canadas major banks are forecasting the central bank will raise the key interest rate by three-quarters of a percentage point bringing it to 325 per cent. Jimmy Jean chief economist and strategist at Desjardins said he thinks the Bank of Canada. Interest rate announcement and Monetary Policy Report.

So far in 2022 the Bank of Canada has hiked the policy interest rate a total of five times with the latest increase in early September pushing the rate up by 075 to from 25 to 325. 3 minute read October 6 2022 735 PM UTC Last Updated ago Bank of Canadas hawkish message bolsters case for another large rate hike.

Bz1in5hyqid82m

Breaking Bank Of Canada Announces Major Interest Rate Hike Youtube

Bank Of Canada Prepares For Further Rate Hikes Despite Market Turmoil Trending News

Usd Cad Bank Of Canada Hikes By 100 Basis Points

Rate Hikes When Will They End And What Happens Next

Improved Economy And Higher Inflation May Force The Boc To Hike Early Nbc Better Dwelling

Bank Of Canada Hikes Rate To 2 5 Here S What It Means For You Cbc News

Central Banks Unleash 350 Basis Points More Of Rate Hikes In Inflation Fight

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/L4K3JTS4GRLCJI22CD6PFVLP4A.JPG)

Bank Of Canada Delivers 0 75 Percentage Point Rate Hike Signals Aggressive Campaign Against Inflation Isn T Over The Globe And Mail

Bank Of Canada Keeps Foot On Gas With Another Supersized Rate Hike Wealth Professional

Bank Of Canada Interest Rate Hike Likely First Of Many Say Analysts

The Bank Of Canada S September Rate Hike Will Be Its Last Cibc Mortgage Rates Mortgage Broker News In Canada

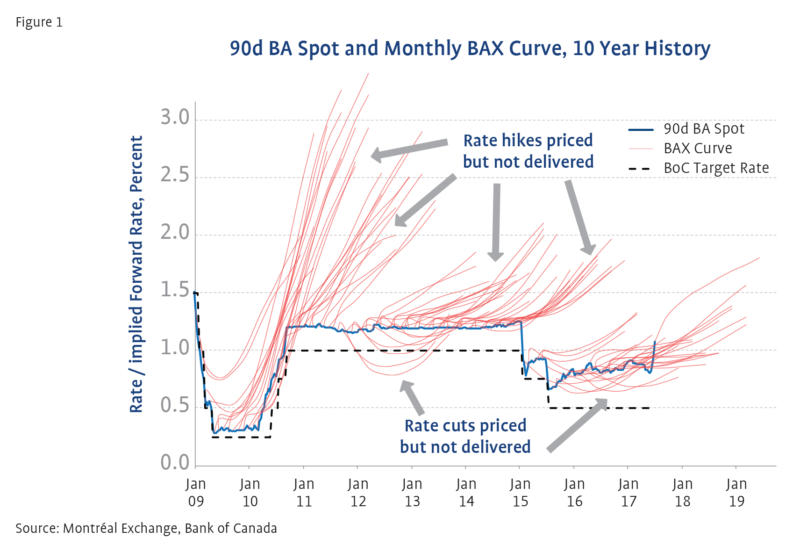

How Well Can The Market Predict The Next Bank Of Canada Rate Hike

Ppbiheilzsxb0m

Bank Of Canada Issues A Supersized Rate Hike

Things Are Not Normal Right Now Bank Of Canada Hikes By Monster 100 Basis Points Hits Mortgages So Might The Fed After Us Cpi Fiasco Wolf Street

Bank Of Canada Announces Half Point Interest Rate Increase The First Oversized Hike In Decades The Globe And Mail